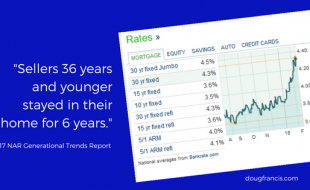

Are we at an Inflection Point? Over the last decade, when home buyers were looking at mortgage rates there wasn't a big difference between fixed rate mortgages and adjustable rate mortgages (ARM). In fact, super-low 30-year fixed rates have ruled the market. Although I don't have a crystal ball, the tea leaves that I'm reading show a Continue Reading

Intent to Proceed Confusion

Do you know when to lock-in your rate or when to pay for your appraisal? Is it your Intent to Proceed? These are two mortgage action-items that buyers will need to complete once their contract has been ratified. Over the past week, I have seen two incidents when there was confusion between home buyers and Bank of America. Understand that my Continue Reading

Mortgage Tip | Stolen Identity Tax Refund Fraud

Last June a buyer client called me in a total panic... "Doug, Bank of America just called demanding written copies of our tax returns from the IRS!” “Okay, did they say why?” I asked. “No, and I have been on hold with the IRS for three hours already. It had to do with fake tax returns that someone submitted last year to scam our Continue Reading

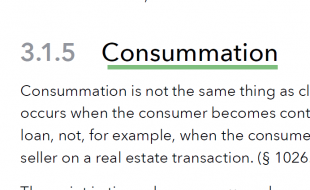

What is Consummation in Real Estate?

When a prominent McLean real estate attorney gave a presentation in 2015 to our office about the upcoming RESPA changes, he used "Consummation" of the sale rather than Settlement. The room chuckled like a class of 8th graders, looking at each other and whispering, "Consummation?" Of course, we were all thinking along the lines of a proper Wedding Continue Reading

The Mortgage Labyrinth

Anyone trying to get a mortgage these days is jumping through hoops like never before. Even those folks with good jobs, have had a mortgage, who are essentially "platinum level" are getting migraines navigating the new underwriting gauntlet. Yes, welcome to The Mortgage Labyrinth. After passage of the Dodd-Frank Act, there were many new Continue Reading

Planning to go for an FHA Loan?

If you are currently in the market to buy a home and plan on using FHA for your mortgage financing, keep in mind that the annual mortgage insurance will be higher for loans assigned case numbers starting April 18, 2011. Local mortgage guy Todd Marumoto of Intercoastal Mortgage in Fairfax, VA sent me an e-mail update about this increase along Continue Reading

Loan Limits for Northern Virginia

UPDATE Loan limits for Northern Virginia in 2022 ~ Original Article: Relocation home buyers are typically surprised to learn that Northern Virginia has maximum conforming mortgage loan limits that are higher than most regions of the United States. Northern Virginia real estate ranks as "expensive" considering the region has some of the wealthiest Continue Reading

Should We Refinance the Mortgage?

I don't usually ask for your comments right in the first sentence, but I have been talking to many clients, friends and neighbors about refinancing their home mortgage these days. And the stories have been fascinating especially since fixed rates are near 4.0% or less. When I originally wrote the post about Virginia's recordation tax exeption Continue Reading