Are we at an Inflection Point?

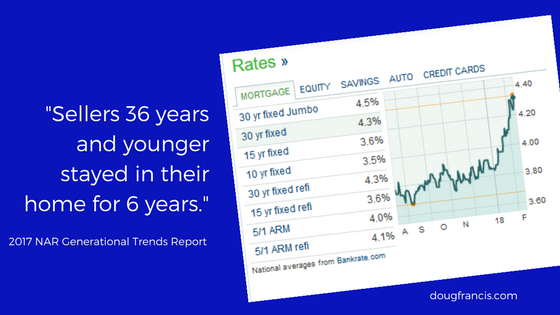

Over the last decade, when home buyers were looking at mortgage rates there wasn’t a big difference between fixed rate mortgages and adjustable rate mortgages (ARM).

In fact, super-low 30-year fixed rates have ruled the market.

Although I don’t have a crystal ball, the tea leaves that I’m reading show a historic shift in the global bond market. With the U.S. committed to issuing staggering sums of debt and European regulators slowing fiscal stimulus programs, the marketplace must start increasing rates to attract investors.

This is the point when ARMs and Fixed Rate mortgages will start to meander in different directions.

Many people still move every 7 to 10 years!

Home sellers 36 years and younger typically stayed in their homes for six years, according to the 2017 NAR Generational Trends Report.

So, how is this going to impact you?

Although working with an experienced mortgage professional is the smartest tact, you can do some preliminary research online using a mortgage calculator.

Mortgage rates change daily and, if you see a significantly lower rate, read closely to see if there are “discount points” being charges.

Always try for an apple to apple comparison.

These loans are amortized over 30 years:

- 7/1 ARM – the rate is fixed for 7 years, and then adjusts every year based on a set formula.

- 10/1 ARM – the rate is fixed for 10 years, and then adjusts every year based on a set formula.

- 30 Year Fixed – the rate will not change.

What you need to check out is the monthly interest differences, and then multiply by 12.

Depending on the term, meaning 7 or 10 years, multiply the annual interest.

Smart buyers are using ARMs to save thousands!

Let’s assume you are buying a home and will have a $400,000 mortgage.

Your lender says the 30-year fixed is 4.5% today.

And the 7/1 ARM is 4.125% today.

Using the calculator below, it shows that the 7/1 ARM saved $88.14 per month.

That equals $1,057.68 per year, and $7,403.76 over the seven-year term.

Try your own numbers…

[mortgagecalculator]

Budget and Strategy

The goal is to find a mortgage that is right for your budget, so talk with your lender about current rates.

Although I don’t originate loans, I’m a Realtor, the 2017 NAR Generational Trends Report referenced a topic that was statistically significant especially in this new era of rising mortgage rates.

So, work the math. And I’m always open to your questions too.