Anyone trying to get a mortgage these days is jumping through hoops like never before. Even those folks with good jobs, have had a mortgage, who are essentially “platinum level” are getting migraines navigating the new underwriting gauntlet.

Yes, welcome to The Mortgage Labyrinth.

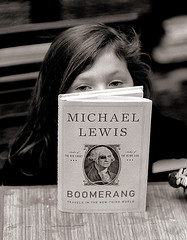

After passage of the Dodd-Frank Act, there were many new regulations put in place to protect consumers from the mayhem experienced during the real estate bubble of 2005-2007ish. Back then, many mortgage lenders were flush with “Wall Street Money” that didn’t require all the red-tape associated with government backed loans. Those loans were bundled up and sold to investors around the world in an elaborate fraud/conspiracy. Author Michael Lewis wrote an interesting book on the topic ~ read Boomerang.

Well, those days are over. and Dodd-Frank has everyone crossing every “t” and dotting every “i”.

Today, applicants often have to provide documentation that they provided documentation.

Recently, in a conversation with Kerry Hogan over at SunTrust Mortgage in Falls Church, he mentioned that people still have many of the same old financial problems as before the extra layer of rules and regulations were put in place:

- late payments

- insufficient credit

- collections

- tax liens

- over extended credit (too much debt)

Ken Harney’s article in The Washington Post on February 23, 2013 pointed out that many people are now dealing with high student loan debt. In fact, it is much higher than for any previous generation, and that extra debt can put a borrower over the rigid qualifying ratio.

I always tell my real estate clients that finding the house is the easy part. It is the financing part of the process that can be grueling, so, getting control of your financial picture a few months before you start the process of house hunting is essential.

The obvious place to start is reviewing your credit report, check it for errors or high balances, and then taking the time to correct them. It doesn’t make any sense to close old accounts because “age” can be positive. Credit scores have to “season” so your adjustments or corrections may not show up for a month or two. Read up on the topic and get cracking!

With a little hard work, you may navigate the mortgage process a little easier.