My clients will remember when I said, "Don't go out and buy his and her BMWs until after you are finished buying the house!" Those days were so simple. Innocent really, almost charming. All that has changed after the recent hack of Equifax essentially exposed everyone's personal financial information to a remote outpost on the Dark Web... Continue Reading

Warning: If You Skip this Home Buyer Tip, You Pretty Much Want a Headache

Did you think there wasn't a top must do? This isn't a tip exclusively for first-time home buyers, so please don't think that you are too savvy to begin with a review of your credit report. The credit report and the resulting FICO Score hold the proverbial keys to your next castle, but can also be the stealthy iceberg that sinks the ship. Why Continue Reading

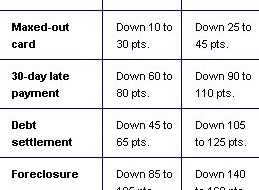

Your FICO Score will take a hit from Damage Points

Real Estate Agents have all wondered how FICO Scores are impacted when events happen to consumers, and FICO has released an informative chart that you need to see. It seems that if you have a high score and are 30 days late on your minimum payment then your penalty will actually be greater than someone who already has a lower score. This great Continue Reading

Your FICO score matters!

Okay, driving through Fairfax County I share my thoughts on the essentials of knowing your FICO Score and the importance of getting a credit report early on in the home buying process. If the FICO Score isn't 700 720 then there may be ways to improve it... since 720+ is the magic number for availability and good pricing. So after you have Continue Reading

Buying a short-sale in Northern Virginia

So you pulled up a listing in the neighborhood that you would kill to live in and it is priced $100,000 below the last sale. "Honey, get the keys cause we are gonna buy that house", you say wildly. What you did not see written into the comments section is this home is a short-sale that needs the lender's approval. Someone in the sale is coming Continue Reading

Fannie and Freddie loans are more expensive April 1

The L.A. Times recently published a piece discussing how Fannie Mae and Freddie Mac were raising fees, and toughening credit rules depending on FICO credit scores. So start watching for "delivery fees" if you are putting down less than 30%. That's not a typo! below 700, add 1.5% 700-720, add .75% 721-739, add .25% Meaning, if you Continue Reading