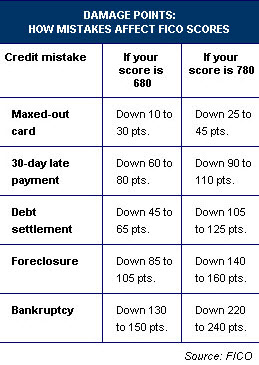

Real Estate Agents have all wondered how FICO Scores are impacted when events happen to consumers, and FICO has released an informative chart that you need to see. It seems that if you have a high score and are 30 days late on your minimum payment then your penalty will actually be greater than someone who already has a lower score.

Real Estate Agents have all wondered how FICO Scores are impacted when events happen to consumers, and FICO has released an informative chart that you need to see. It seems that if you have a high score and are 30 days late on your minimum payment then your penalty will actually be greater than someone who already has a lower score.

This great chart came to my attention from a post Justin McHood wrote at “The Phoenix Real Estate Guy.com” and I felt it was important to share. Consumers have a resposibility to manage their credit and can get a copy of their report either through a service like Equifax or free through AnnualCreditReport.com. Requesting a report to review will not negatively impact your score, but if you apply for a new BuyMore-Card then it can be a ding. Get it?

In a recent post of mine, I mentioned how important having a 720 or better score is when trying to get a mortgage, and how a real estate client had one error repeated three times impacting his FICO Score. Once cleared his score jumped 40 points!

So let’s be careful out there during the Holiday Season in Northern Virginia and not run our cards up to the max because that will damage your score 20+ points… even if you did it by accident. There are plenty of stories out there to keep you up at night. Keep it real because you need to keep your credit reputation as good as possible in today’s world. And remember that is important to examine your ratio of available credit to used credit… an important FICO Score variable.

Related articles by Zemanta

- Clearing up confusion on credit scores (sfgate.com)

- Where to Get Credit Report & Credit Scores [Credit] (consumerist.com)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=88973f5c-6488-44d0-b5ba-71dcd7e55640)