Why do you need to check your contract for specific deadlines?

When you have finally been able to get a seller to accept your offer, the last thing you want to hear is that you missed a deadline in the sales contract. There are deadlines for inspections or contingencies that keep the whole process rolling.

Simply, they mean that there is structure and everyone involved will be performing their best to meet the deadlines in the contract.

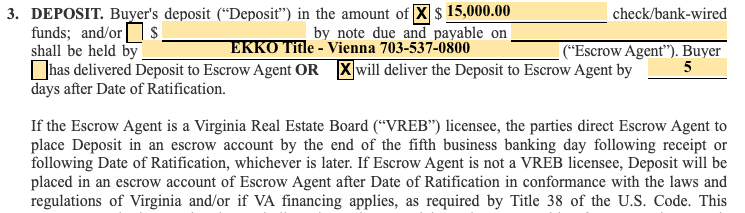

Earnest Money Deposit

A home buyer’s Deposit or Earnest Money Deposit (EMD) is money put in an escrow account after a contract is Ratified to demonstrate good faith. I like to think of it as putting your money where your mouth is… that you are serious.

As an aside… There must be a blog post out there regarding using only a percentage of the sales price because I often see offers on listings with small Deposits. Beware of this strategy because that could be the reason you are the loser in a competitive bidding situation. That’s all I’m going to say about that right now.

So, your offer was Ratified (accepted) and the clock has started!

Reread your real estate contract

I happen to be in Virginia outside Washington, D.C., and the buyer’s EMD needs to be deposited within five days of contract acceptance or Ratification, or by a mutually agreed upon date. Our contract also shows who will hold these funds… the real estate company, Settlement Agent or Title company.

These days, my recommendation is the arms-length Settlement Agent.

Imagine if you gave your check to the correct person and they did not deposit your check? Well, a friend of mine who is buying a beach house out of state just called me to discuss just such a senario.

He FedEx’ed the check, it was received, and then delivered as outlined in the contract. But, ten days later, the check had not been deposited.

Understand that there is an ethical obligation to deposit this money in order to preserve the integrity of the contract. The Seller and the Buyer expect each other to live up to the spirit of their agreement but, in this case, a third party is causing an issue.

Unfortunately, it was the seller’s Realtor who is holding onto the check.

My quick assumption is… did she lose it?

Your mortgage guy is on your team

Most people use a mortgage to help them buy a home. And with rates below 3.5%, borrowing money for 30 years is a smart way to leverage your finances.

In my friend’s case, they have a mortgage loan in process of getting approval. This process still requires job verification, a solid credit report, verification of assets to close, and a few month’s worth of bank statements. If they are lending you 80% of the price then they certainly have an obligation to make sure you are solid.

One critical piece of the paperwork is verification that the deposit has cleared the bank and the funds are in an escrow account.

Here is the problem… his check hadn’t even been deposited!

Contract closing date

Again, let’s go back to your sales contract to see when you agreed to close or settle. That is a “hard deadline” for all parties.

Deadlines are included for a reason so everyone performs their part.

Obviously, you are expecting the seller to be moving out of the house, right?

Recommendations

Homebuyers, I like to recommend a Settlement Agent near where the property is located. If the house is in Vienna, VA, then a Vienna Settlement Agent. In Falls Church, then one in Falls Church. In McLean, then one in McLean.

Some Realtor agencies may have an affiliation with a company… check them out too.

In my opinion, your Deposit really should be designated to be deposited with the Settlement Company, and not with the Seller’s Realtor.

Understanding what every paragraph in a contract to buy a home means is difficult if you buy a house once a decade. There is a high level of risk here and no one wants to lose a deposit because a “hard” deadline was missed.

Remember, any questions will always depend on specific language in the contract.

And my friend did take my advice having his agent and his mortgage guy call the agent to ask what was up? The check was deposited later that day.

Cheers!