Condo buyers that pay cash are typically savvy real estate investors looking to cash in on the current low prices with plans to rent out the properties. Although there are many places where that plan is a good bet, places such as Reston, Virginia may be a whole other story.

You see, Reston is an ideal location for investors because a Metrorail line is being built from Reston to Washington DC. Reston also has an impressive workforce clustered around the Town Center and Dulles Corridor – so there is continuous demand.

This scenario sounds pretty good to me as well, but there area lot of people who want to get on that train too and are willing to do anything to get onboard.

Are you missing the big picture?

Owner occupants getting loans for condos have to jump through some extra hoops meant to protect (the lender) from placing a residential loan in a “commercial” building. A commercial residence is defined as having a larger ratio of non-owner occupied units to owner occupied units. Also, they tend to look at F.H.A. approvals and other financials.

Last week’s conversation on CNBC about real estate and cash buyers really got me thinking about what I was seeing right here in the Reston condo market with cash buyers (investors) often out bidding owner occupants.

Luckily, condo buyers paying cash don’t need all that nonsense!

Well, it isn’t all nonsense…

So what is the Investor Ratio?

Although you may be well intentioned as a real estate investor, it is important for you to understand how many other well intentioned investors are in your building. This figure will be especially important when you plan to sell (cash out) and buy something in the future. If the ratio is too high then it may be difficult for perspective buyers who need financing.

Is the property F.H.A. approved?

Although the F.H.A. has made it tougher to maintain approval, many condos that had approval have not renewed their status. Again, this may factor into your plans when you plan to sell (cash out) and put your cash into another investment. Another investor may impact your condo’s resale market if one investor owns more that 10% of the units.

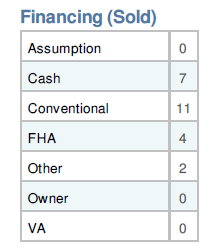

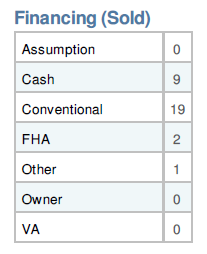

By the way, take a look at those two charts and notice how few FHA loans were placed each month. To check on approvals, click here for F.H.A. and here for Fannie Mae lists.

How solid are the condo’s cash reserves?

Although you are going to pay your monthly condo fees, you need to know how the finances look right now because, if 10% of the building is behind on their payments, then you may want to reconsider the building. It is a slippery slope when that badly needed cash flow dries up and reserve requirement aren’t being maintained. So, examine the financials.

Read the Condominium Disclosure Documents

These will give you plenty of financial details, but look to see if there is a self imposed cap on rental properties. I know one condo where there is a very restrictive cap on rentals – at 20%. Better yet, they are at the max already so you will need to apply for a spot when it comes available. Sorry, it’s in the bylaws!

Have an exit strategy

Remember that getting your money from this type of investment is not easy, especially if you are buying it with partners. This is a trend I’m seeing since so many people are earning 0% in their money market accounts and the cash flow from a rental is appealing. It is your principal that is locked up until you sell. If you don’t have a plan then you may get stuck with a lemon for a long time.

Related articles

- Video: Toronto becoming a town of renters as investors dominate condo market (moneyville.ca)

- When Should You Respond to Counter Offers? (dougfrancis.com)

- Are School Ratings part of your Home Search? (dougfrancis.com)